Why Choose SunnyHill

Industry leader in VA loans

Our CEO Tyler Flora comes from a military family and has always felt it important to respect the sacrifice our veterans made for our country. He has been outspoken about mortgage lenders taking advantage of veterans and has put a major focus on giving veterans access to the best loan programs on the market. When you work with SunnyHill Financial you can feel secure knowing that you will receive a loan originated at a low margin, with transparent communication, with a variety of different options. Reach out today and see if we can beat your current loan offer or answer any questions you may have about the home buying or refinancing process.

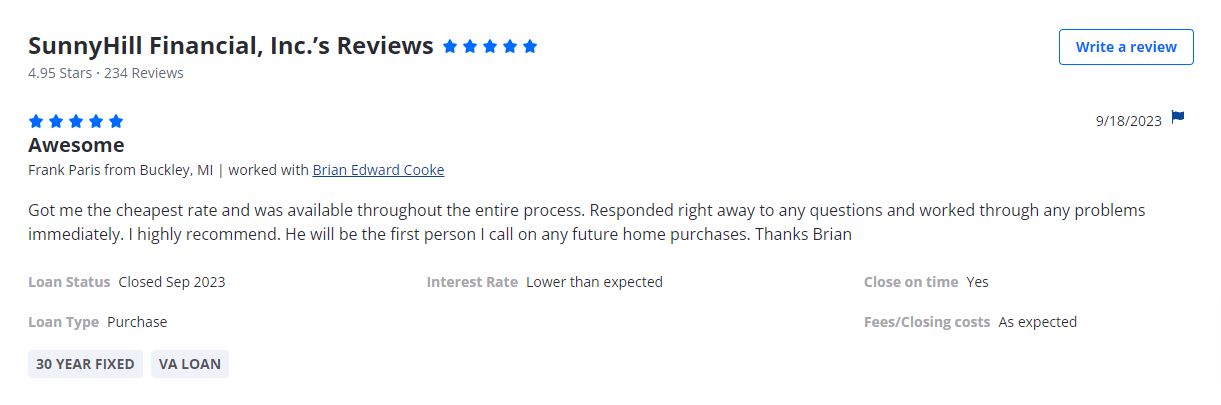

See what people are saying

Other SunnyHill Products

We offer other services that anyone can benefit from.

Contact

Call us: 650-678-0283

Licenses:

- AZ license # 0951179

- CA DRE # 02058287

- CA DFPI # 60DBO99712

- CO

- FL license # MBR2562

- GA license # 71319

- ID license # MBL-2081708856

- MI license # FL0022770

- NV #5570

- NC # B-190746

- OH # RM.804604.000

- OR

- PA # 76238

- TX

- UT license # 10993905

- WA license # CL-1708856

- Company NMLS # 1708856